Transaction Processing

- Processing of all financial transactions, posting, calculation of fees and charges, updating of account balances according to product parameters, record preparation for General Ledger

- Automatic transaction analysis, filtering through complex system of rules and listing of suspicious ones for business decision makers to initiate appropriate risk related actions

- Support for VISA and MasterCard dispute processes, applicable to any other similar international or a private card organization requirements

- Acceptance and processing of instant payment orders from CORE Banking Systems and from other external sources such as eBank and mBank systems, ATM or POS network, eCommerce system, payment institutions or other

- Efficient set of tools to detect, investigate and report money laundering activities

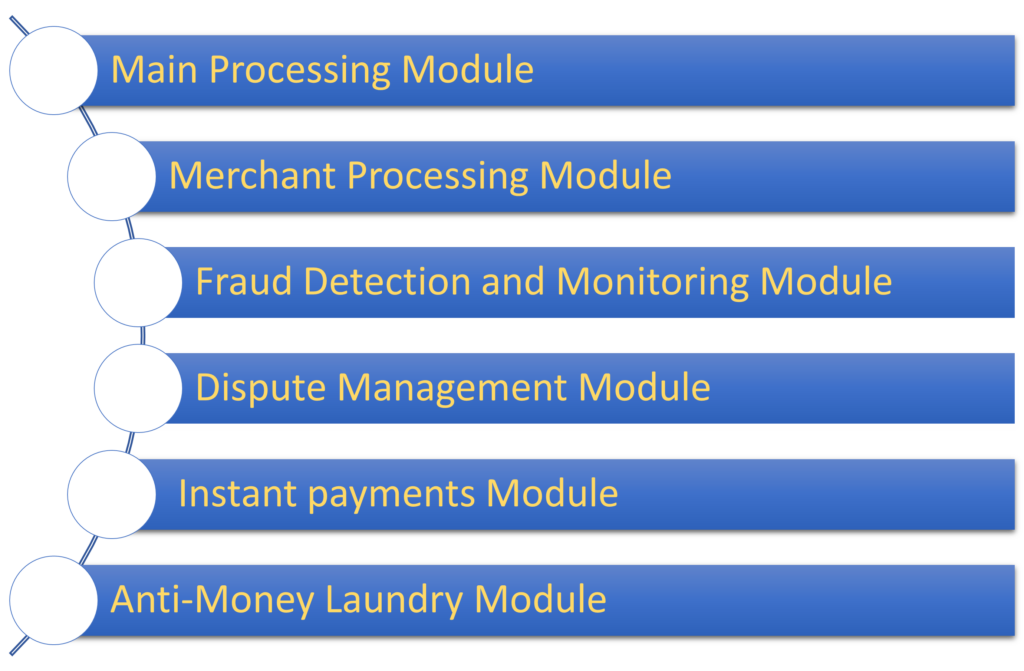

- Main Processing Module:

– processing of all financial transactions (collection of clearing files and supporting reports, processing of transactions from the bank’s acquiring network(s), processing of bank card transactions created in networks of other banks),

– calculation of fees and charges,

– update of account balances according to product parameters,

– generation of data for General Ledger (preparation of posting files, generation of files for exchange with other banks)

– generation of required reports and reviews. - Merchant Processing Module (merchant fee calculation, merchant commission calculation, merchant payment processing, merchant reporting)

- Instant Payment Module (exchange of instant payment order data between the Bank and Central Instant Payment clearing and settlement Services, ISO 20022)

- Fraud Detection and Monitoring Module (rule based, „near-real time“ or „real time“, simple or complex rules, single interface for both issuer and acquirer activities)

- Dispute Management Module (full dispute lifecycle, single interface for both issuer and acquirer activities)

- Anti Money Laundering Module (can be interfaced to any banking application, various types of “blacklists” such as OFAC, UN, Bank’s lists…)

5000

banking transactions per second

30

years of experience

20+

million banking cards in the system