Card Acceptance and Transaction Management

- Management of any number/combination of touch point device types (EFT POS, ATM, KIOSK) at the same time

- Management of multiple acquirers on one single EFT POS

- Sharing of ATMs among acquiring institutions

- Management of virtual EFT POS on ATMs

- Distribution of banking services via merchant EFT POS network (Agency banking)

- Terminal Issue and SLA management, Cash management, Marketing and Campaign management, Transaction switching

- Full internet and mobile channels support

- Rich integration capabilities through use of various protocols or methods for integration

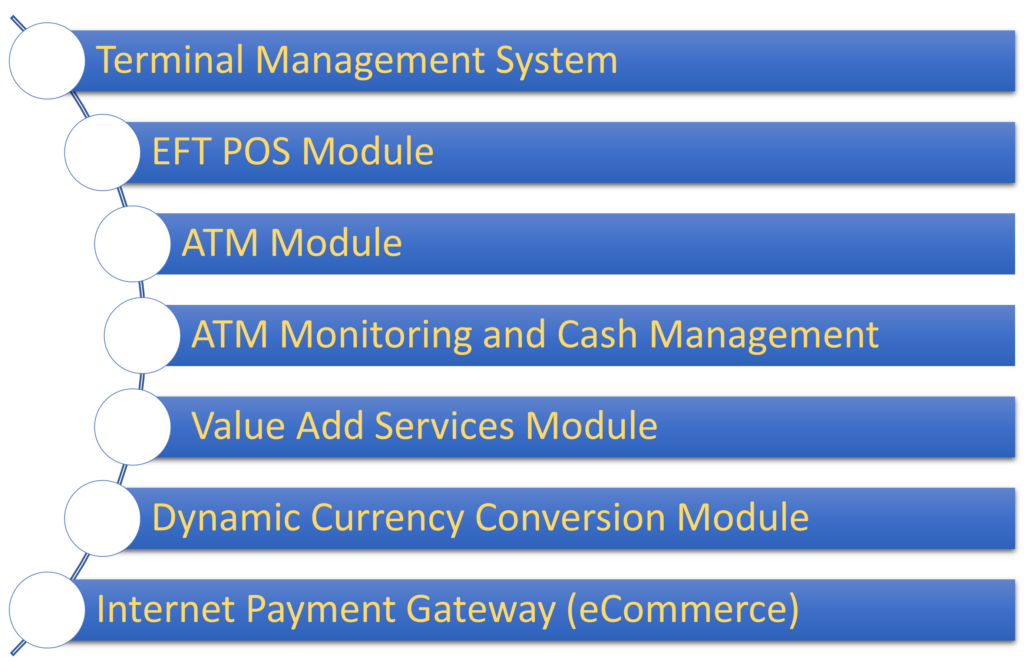

- Terminal Management Module (Universal Channel Management, EFT POS, ATM, Kiosk, Internet, Mobile)

- EFT POS Module (multivendor, Verifone, Ingenico, PAX, Prolin, Android)

- ATM Module (multivendor, NCR, Diebold Nixdorf, Hyosung, OKI, cardless payouts, currency exchange office)

- Cash Management Module (ATM cash position monitoring, cash forecast , load optimization, cash orders, cash settlement)

- Issue Management Module (device monitoring, issue management and alerting, EFT POS, ATM Kiosk, SLA management, cash management)

- Dynamic Currency Conversion Module (both ATM and EFT POS)

- Value Add Services Module (EFT POS, ATM, Kiosk, vouchers, bill payments, prepaid and postpaid billing models)

- E-Commerce Module (Internet Payment Gateway, management of cardholder authentication on the acquiring side during „card not present“ transactions)

- 3DS Server (3-D Secure protocol versions 2.1, 2.2, and 2.3.1.0 supported, App-based, Browser-based, and 3RI-based channels supported):

– Frictionless and challenging authentication.

– Decoupled authentication.

– Secure Payment Confirmation SPC-based authentication.

– Multiple Directory Server compliance (Visa Secure, Mastercard Identity Check, UnionPay UP3DS, Discover’s ProtectBuy).

– Easy integration with payment gateways including a self-testing environment.

– Detailed transaction reporting including exchanged 3-D Secure messages review.

– Summary transaction reporting.

5000

banking transactions per second

30

years of experience

20+

million banking cards in the system